Augur Project Analysis

Breaking down the the decentralized prediction market project: Augur.

In my last post, I went into detail on what a prediction market is and why I think it is perhaps the most compelling blockchain use case. In this post I will do a deep dive into Augur, one of the leading decentralized prediction markets. This article will cover the following:

Development Structure & Monetary Supply

Process Technicals

Token Incentives & Attack Vectors

Timeline

Augur is a Decentralized Application (DApp) on the Ethereum Blockchain. Augurs native token, Reputation (REP), were issued in a token sale (ICO) for payment in Ether.

Development Structure & Monetary Supply

Augur was one of the first token offerings on the Ethereum Network with the sale going from Aug 17, 2015 to Oct 1, 2015, raising around $5,000,000. Augur’s token, REP, has a total supply of 11,000,000. 80% of the total REP was sold to the public during the ICO, 16% went to the Augur founders, and the remaining 4% going to the Forecast Foundation. The issuance of REP is one of the most generous in the ICO space. Many projects keep very large percentages of the total token supply, which can lead to high inflation for investors and sometimes a beyond reasonable windfall for founders.

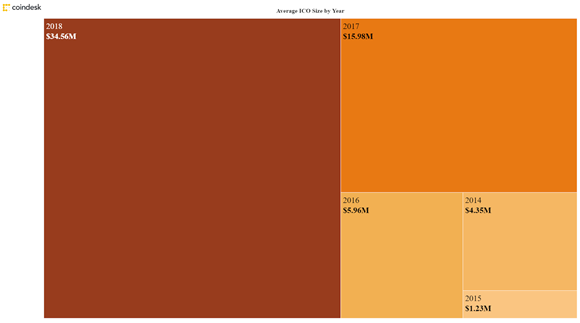

The $5 million raised for the Augur ICO was high for 2015, with the average ICO raising $1.23 million. However, compared to the amount that projects are raising today, 5 million is abysmal. This graphic from Coindesk.com shows the average ICO size by year. The 16 and 35 million dollar averages for 2017 and 2018 even understates the amounts raised for high profile projects — which exceeded $1 billion multiple times.

While it’s impossible to predict how much Augur would have raised had the ICO been in 2017 or 2018, we can at least expect it to have been one to two orders of magnitude larger. This begs the question of whether this is a good thing. Obviously on the surface raising more money seems to be beneficial, but too much money can break a project in such early stages.

The Forecast Foundation is the organization responsible for the issuance and development of the Augur protocol. Jack Peterson and Joey Krug are the primary founders of the project, with Vitalik Buterin as a lead advisor.

Augur has a very strong development structure. Having Vitalik as an advisor can also not be understated, as he has clout that is nearly unmatched in the blockchain space. In addition to clout, Vitalik’s presence is also very important due to Augurs strong dependence on Ethereum and in turn its ability to scale. Augur has also received funding from some of the most prominent crypto hedge funds.

Process Technicals

In my last post I went over a high-level example of how a prediction market functions. I will now go in-depth on the lifecycle of a prediction market in Augur, which can be broken down into 4 stages: Creation, Trading, Reporting, and Settlement.

Creation

The person who wishes to create a prediction market on a certain event is called the market creator. The market creator specifies an event such as “How many gold medals will Michael Phelps win in the 2008 Olympics?”. They then set the event end time and define all the possible outcomes that can be wagered on. In our example the possible outcomes would be 0,1,2,3,4,5,6,7, and 8. Since Phelps only raced in 8 events, that would be the ceiling on potential gold medals.

The market creator must stake an amount of REP at the creation of the outcomes, called the validity bond. If an outcome is reported that is considered invalid, then the market creator risks losing their REP. The purpose of this is for the market creator to set unambiguous, well defined outcomes, else they risk losing money. An example of this would be if the outcomes for Phelps’ number of gold medals was: “a lot” or “a little”, or if the creator set the max number of medals at 7 instead of 8. This also incentivizes due diligence in that the market creator must include ALL possible, clearly defined outcomes.

Next, the market creator picks a resolution source, such as NBC.com, that is used as the truth about the event’s outcomes. However, as I discussed in Part 1, this resolution source can potentially be manipulated, which is why the market creator also chooses a designated reporter. The designated reporter stakes their REP within three days of the event end time on a tentative outcome. The market creator must also stake some of their REP on their designated reporter, called a no-show bond, which they lose if their designated reporter fails to report on time. This incentivizes a market creator to choose a reliable designated reporter.

The designated reporter should report on the truth of the outcome using the resolution source, unless of course they deem it to be compromised. The designated reporter has an incentive to truthfully report or else they could lose their stake, as I will go into in more detail in the next section.

Lastly, the market creator sets a creator fee (from 0%-50%) for their efforts, which is paid to the market creator by the traders who settle with the market contract. The fee can be lowered but cannot be raised. The fee incentivizes market creators to create markets but can be lowered if an identical market is created to undercut the original.

To summarize the actors and terms involved in the creation stage:

Market Creator: The person who creates the prediction market.

Event End Time: Specified by the market creator as the end of the event.

Event Outcomes: The specific outcomes of the event, set by the market creator

Validity Bond: REP that is staked by the market creator that is returned if the event outcome is one that they specified at creation.

Resolution Source: The source of truth that reporters should use to determine the outcome, can be an API endpoint, a website, or even “common knowledge”

Designated Reporter: Chosen by the market creator to report, within 3 days of the event end time, on the correct event outcome.

No-Show Bond: REP that is staked by the market creator that is returned if the designated reporter reports an outcome on time.

Creator Fee: The fee that is set by the market creator to compensate them for their efforts. The fee is set from 0% to 50% and can be lowered at any time.

Trading

Once the market has been created, people are then allowed to begin trading on the outcomes. While it is used extensively in the creation stage, REP is not used by traders to make their bets. Instead, ETH is used as the currency for trading. One issue with using ETH is that payouts will naturally be skewed based on the volatility of the price of ETH. This problem increases the farther into the future the event end time is. The price of ETH could begin to stabilize into the future as it gains prominence, however no one knows when that will happen, if it ever does.

A solution proposed by the Augur team is to utilize stablecoins. A stablecoin is a cryptocurrency whose value proposition is that its value remains relatively stable. This can be achieved in different ways, but an explanation is beyond the scope of this post. If you wish to get a primer on stablecoins I recommend Myles Snider of Multicoin Capitals post “An Overview of Stablecoins”, which outlines in more detail the different types of stable coins and how they work.

The trading stage of the prediction market life cycle concludes at the event date time, in which we enter the reporting stage.

Reporting

Once the designated reporter reports a tentative outcome within 3 days of the event date time, there is a seven-day period in which stakers of REP can dispute the tentative outcome. The REP holders stake as much REP as they like on a given outcome that they believe to be true that varies from the tentative outcome. The REP staked at this time is called the Dispute Bond. There are now two scenarios that occur:

The Dispute Bond is not big enough to successfully dispute the tentative outcome during the seven-day dispute period. This means that the designated reporter’s tentative outcome was accurate, confirming the outcome of the event and moving us to the settlement stage.

The amount of disputed REP successfully disputes the tentative outcome. The stakers that successfully disputed a false outcome would get a fixed ROI of 50%. This payment comes from the REP stakers that reported the wrong event. If an outcome is successfully disputed, then the staked outcome becomes the new tentative outcome, and another dispute round follows.

Forking

The forking stage only occurs during special circumstances when there is a market outcome with a successful dispute bond containing at least 2.5% of all REP. Forking is Augur’s market resolution method of last resort. This stage acts as a final settlement by making stakers risk “losing” their REP if they choose a minority outcome.

Settlement

Once the outcome is determined the shares that bet on the winning outcome become redeemable and the other shares become worthless.

Token Incentives & Attack Vectors

The Augur protocol removes the ability of any one person to determine a market outcome by utilizing the individual incentives of REP holders. The market creator is incentivized to create a well-defined market through the validity bond. They also must choose a responsible designated reporter through the no-show bond. The reporters stand to make fees if they stake on the outcome that is in the majority. This is where the game theory comes into play in that the reporters assume the true outcome will be the majority outcome.

There is no shortage of potential attack vectors on Augur. A Reddit post by Tarak80 does a great job outlining some of these along with potential solutions. Most of the attacks are based on the assumption that the attacker is able to attain a large amount of the existing REP supply, something not uncommon to Proof of Stake type consensus mechanisms.

Current State & Timeline

After 3 years of development, Augur went live in July 2018. At time of writing there are 1,081 markets with ~$1.1 million at stake.

While a huge milestone was reached, there is still a lot of work to do on Augur. UX and Fees are two main pain points that will need to be solved before Augur can gain more traction.

User Experience: As it stands now, your technical competence must be staggeringly greater than the average person if you want to do anything on Augur. This is something that will happen in time, as companies see the opportunity of providing people to access the Augur protocol in an easy and streamlined manner.

Fees: The lead developer of Augur, Joey Krug, wrote an article recently about the fee problem currently on Augur. To summarize, there are 5 sources of end-to-end fees for someone to begin using Augur. Most of these should be fixed in time as Ethereum scales, Augur open interest grows, stablecoins get implemented, and fiat to crypto on ramps become cheaper.

Conclusion

While Augur still has a way to go, the progress so far has been significant. By utilizing game theory and incentives they have created a fully functional decentralized prediction market that has the power to change the aggregation of global information.

Disclaimer: The views expressed in this article are solely the author and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.