Another Look at Bitcoin's Environmental Impact

Why the hysteria around Bitcoin's energy usage is exaggerated

A red herring is a logical fallacy that leads people towards a false conclusion. Intentionally or unintentionally, a red herring is a plausible, though largely irrelevant, diversionary tactic. You may see one following a fact or opinion but without actually addressing it. Pulling Wikipedia’s example: “I think we should make the academic requirements stricter for students. I recommend you support this because we are in a budget crisis, and we do not want our salaries affected.” Clearly the latter sentence doesn’t directly relate the former. It could potentially be related, but it is most likely being used to push a hidden agenda. This is an example of a red herring that is likely intentional.

Another red herring: “Bitcoin uses more energy than Denmark, and will increase to X amount in Y years. Therefore, Bitcoin is causing global warming.” This example is different than the one from Wikipedia, in that I believe it is nearly always unintentional. It is especially tricky because it does not appear to be a red herring: on the surface — it makes sense. Of course energy consumption causes global warming, right?

Stating how much energy Bitcoin mining uses is a fact, unarguable, and is not wrong by itself. But by directly correlating that to global warming ignores some very important facts that must be considered. This isn’t in the least bit surprising, humans are wired to make connections like this to form a neat and concise story. This narrative is even easier to get your head around if you want to believe it; but as always, the devil is in the details.

Clarifying the Argument

Let’s quickly rehash the argument broken down into its three components: “Bitcoin uses more energy than Denmark, and will increase to X amount in Y years. Therefore, Bitcoin is causing global warming.”

Statement 1: “Bitcoin uses more energy than Denmark”

Statement 2: “will increase to X amount in Y years”

Statement 3: “Therefore, Bitcoin is causing global warming.”

Statement 1: Comparing Bitcoin’s Energy Consumption to a nation state

This is true and then some — when this statement was made, Bitcoin was using about 32 TWh annually (Denmark uses around 32 as well), and it is now using ~55 TWh. Note that these metrics are describing the electricity consumption of each.

Now despite this being true, it is important to get some reference. The world electricity consumption is close to 22,000 TWh, of which Denmark makes up 0.143%. Therefore, Bitcoin currently accounts for roughly 0.305% of world energy usage.

Now this is actually still quite considerable when you think about it, and most people would still say this is a problem, but a little context makes it more digestible than the original statement. If you have read Factfullness by Hans Rosling, the chapter titled “The Size Instinct” gives some insight into this bias.

Statement 2: Bitcoin’s Increasing Energy Consumption

First it is important to explain how we go about calculating the energy consumption of Bitcoin — which is not an exact science. It requires some calculations and assumptions, leaving us with an upper and lower bound for how much electricity it uses.

Put simply, Bitcoin mining is essentially the action of computers performing hash calculations over and over again until they find the “correct” one. Now miners don’t report how many hashes per second that they are currently calculating, but based on the frequency of Bitcoin blocks (“correct” hashes) and the current difficulty, we are able to estimate the number of hashes that are being performed every second.

As of writing we can estimate that the Bitcoin network is currently hashing about 40,000,000 TH per second, which is equal to 40,000,000,000,000,000,000 hashes per second.

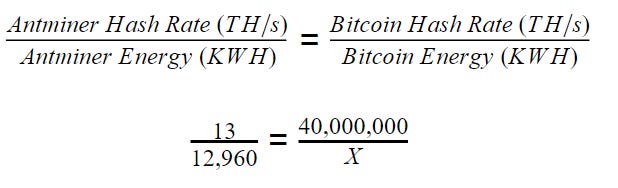

If you don’t understand most of that, it’s ok, all we need to know for the first part of our formula is that we estimate the Bitcoin network performs 40,000,000 TH/s. The second part of the formula is to estimate how much energy it takes to get one hash (or TH/s). This again is difficult to determine exactly, because depending on the mining equipment being used, the energy efficiency changes. The Antminer S9 is a common Bitcoin ASIC miner which performs about 13 TH/s and uses about 12,960 KWh / year in energy.

To see a back of the napkin calculation of Bitcoin’s energy usage we now have 3 data points

Antminer S9 Hash Rate: 13 TH/s

Bitcoin estimated Hash Rate: 40,000,000 TH/s

Antminer S9 Energy / Year: 12,960 KWh

Bitcoin Energy / Year: = X KWh

To get the Bitcoin Energy per year we fill in the proportion:

Which gets us to X = 39,876,000,000 KWh, or ~40 TWh. Of course the biggest assumption in this equation is the type of mining equipment being used — which is impossible to know. This also makes it difficult to calculate Bitcoin’s energy consumption in the past, when FPGAs, GPUs, and CPUs were used to mine.

Now that we know how Bitcoin’s energy consumption is calculated, we can look at how it has grown over time and how it will grow into the future.

Bitcoin mining is a competitive industry, and the number of miners joining or leaving the network is largely predicated on the price and the block reward. This is because the revenue for a miner is calculated as such:

Blocks won: This is the number of blocks that a miner is the first one to find the “correct” hash for. It is proportional to the amount of hashpower the miner has relative to that of the entire network

Block reward: The number of bitcoin given to the winner of each block. The number started at 50 and halves roughly every 4 years. The current reward is 12.5 and will drop to 6.25 in 2020

Price: The current price of bitcoin

On the other side of the equation is the marginal expense of mining, in energy costs. If the revenue for a miner falls below the cost to mine, then we can expect the hash rate to fall as miners halt operations to avoid mining at a loss.

Two things can cause this to happen that are out of the control of the miners: price and reward. But since reward is known into the future, the hash rate is largely dependent on the volatile price of bitcoin. As the price rises we expect to see an increase in hash rate due to the increase in margins. However, the drop in reward will eventually reach an equilibrium with the price increase. (The difficulty adjustment is not as relevant here since the highest marginal cost miners will still fall out as the price of bitcoin falls).

As the price increases quicker than the drop in reward, we can expect to have an increase in hash rate, but this will not always be the case. For that reason, we can expect the energy consumption of Bitcoin to rise until a certain point, where it will plateau, as it is no longer economical for miners to join the network.

This is a very hard number to estimate, I have seen estimates anywhere from 1% to 10% of global energy consumption once Bitcoin reaches equilibrium. Now this does assume that Bitcoin “succeeds” and the price continues to rise, which of course is not a certainty. However, if Bitcoin fails to gain adoption then its energy consumption won’t really matter, therefore nullifying the purpose of the entire argument.

Statement 3: Bitcoin is Causing Global Warming

To say Bitcoin is causing global warming is to say that all of its electricity consumption comes from sources that emit high amounts of CO2, but this is not necessarily true. Bitcoin miners will flock to an energy source that can ensure them the best margins, so where is the cheapest electricity?

Places like Iceland & Canada have massive amounts of energy in the form of geothermal or hydroelectric power. Due to its low marginal cost of additional power generation, hydro is a great energy source for the mining of bitcoin. A problem with this type of energy though, is that it does not transport or store well. This is why you cannot export the raw energy sourced from geothermal or hydroelectric power. Additionally, hydroelectric dams are usually in remote locations further exacerbating this problem. One of the primary ways to “export” the energy from hydroelectric dams is from aluminum creation —a process that requires a lot of electricity, similar to Bitcoin. However this is not enough to maintain full capacity of all hydro dams, let alone satisfy all the potential areas where more could be built. This is marginally free and clean energy that can’t be fully utilized since demand is far less than the potential output from these sources.

Places like this are a natural place for Bitcoin mining farms to be located, since the marginal energy is cheap, and the air is cold (lowering A/C costs). If Bitcoin is primarily mined from electricity sourced from geo or hydro that is currently being wasted then it completely refutes the argument of Bitcoin’s CO2 emissions. But the question becomes — where are the miners and how do they get their electricity?

While there are a lot of miners in Iceland, we know that most of the farms are in China. Here is a breakdown of China’s electricity production:

As you can see China gets most of its energy from coal, with the second most from hydroelectric.

Going back to the fact that energy doesn’t travel or store well, sources like coal and gas eliminate this problem. Since they can be shipped around the world and burned on demand, it’s no surprise that coal, gas, and oil make up the majority of the world’s electricity consumption. But in exchange for their transportability, they are more expensive* than using a renewable source — which is why Iceland burns almost no fossil fuels.

*Note that fossil fuels are more expensive than renewables at the marginal level, or once the capex has already been spent to extract the renewable. In other words, once you have set up solar panels, it doesn’t cost any money to generate electricity.

So why on earth are there so many Bitcoin miners in China? The answer of course is cost, and below I list a few of the reasons why:

Hydroelectric

Despite 72% of their energy coming from coal, China still commands a massive amount of hydroelectric power. Based on its sheer size, the 20% of China’s electricity that comes from hydro make it the biggest in the world, accounting for 30% of the worlds hydro power. One of the reasons for their massive increase in hydro is from aluminum production. Some would argue that China has over-invested in hydro for aluminum, leaving a large number of hydro dams underutilized. Bitcoin can essentially replace aluminum as the primary export of these underutilized dams.

Proximity to the Source

The largest manufacturer of ASICs (the chips used to mine bitcoin), Bitmain, is in China. Being close to the manufacturer of this equipment is also a source of costs saving. Not to mention that Bitmain also runs mining farms, it makes sense to have their operations near each other.

Corruption and Subsidies

It’s no secret that the Chinese government will eat costs to make their industries more competitive. Through a variety of methods, and for different reasons, the bitcoin miners could be getting a discount on their electricity.

Economies of Scale

Once a mining farm is set up, it’s much easier expand locally, than to deal with migrating to a different country. Since there are already massive mining operations set up in China, they might as well build more.

For these reasons it makes sense why the costs of a Chinese miner expanding in China is much cheaper than setting up elsewhere, despite the electricity potentially being “cheaper”. Now it may seem that Bitcoin mining will always be located in China, but I don’t see this as a foregone conclusion.

The temperament of the Chinese government can be very fickle, especially when dealing with a cryptocurrency that undermines their ability to keep capital in China and maintain surveillance on the population. Bitmain itself has been having issues lately as well. As the cost of capex goes down (the price of ASICs) it will become continually more economical for miners to setup in areas with cheap clean energy.

To summarize, Bitcoins electricity usage does not automatically convert into CO2 emissions. Even in a country like China that uses coal to fuel 72% of their energy consumption, we can assume a large amount of the mining is done through clean energy sources.

Now that we have explored the nuances of the “Bitcoin will burn the ocean” argument, I will now discuss the counter arguments.

Counter Arguments

Counter Argument 1: In Relation to What?

Bitcoin uses a lot of energy, that much is clear, and it will continue to do so as it gains adoption. But the question now is more adoption in relation to what? If Bitcoin gets adopted on a mass scale, will it cause other energy consuming activities to go down?

This is an extremely tough question to answer, as the future impact of Bitcoin and cryptocurrency is so beyond our current scope of understanding. But the first step is to look at what Bitcoin could potentially replace or reduce: gold mining, paper currency and minting, banks, etc. As a thought experiment, let’s say Bitcoin eliminates (or dramatically reduces) the need for banks. The current banking infrastructure (buildings) could be used by other companies, reducing the energy required to build more. The electricity or operational energy demands of the banking system would be eliminated as well. While I don’t think this is likely, the point is to show that Bitcoin could shift the current system into something different than we have today.

As I mentioned above, this is very difficult to quantify. Dan Held has a terrific article that goes into some of this, where he tries to estimate the yearly cost of some of the things Bitcoin could replace. However I think it’s more important in regards to the argument to just consider the fact that Bitcoin will not increase the world’s energy consumption without reducing it in other areas too. It may still be a net increase, but it could be less than just the gross amount being forecasted.

Counter Argument 2: Shifting Incentives

We have now reached what I find to be the most interesting part of this entire argument, which is the way that Bitcoin can change the incentives for the development of green energy. I will first rehash the relevant differences between renewables and fossil fuels:

Marginal Costs

Renewables such as solar, wind, and hydroelectric have close to no marginal costs once they have been built. Once the money has been spent on a turbine, a dam, or a panel, the only cost associated with generating electricity is from the operational costs and upkeep of the hardware.

Transportability & Storage

Once electricity has been generated through a renewable source, it is very difficult to transport. Batteries are not economically viable for Iceland or Canada to store and ship out their surplus electricity. Storage is difficult and expensive for the same reasons. Consumer solar panels can utilize batteries, but they are currently extremely inefficient, which is why Elon Musk is so intent on building better batteries. On the other hand, fossil fuels such as coal and oil, transport extremely well and can be burned on demand and fed through the grid.

In this section I want to focus on the transportability aspect of renewables, particularly wind and solar, because this is one of the biggest barriers to the development of renewable energy sources. Solar panels only generate electricity during the day, however peak electricity demand peaks from 5:30–7:30. Wind can also be significantly off peak times if it’s very windy at night, for example.

If you are thinking of building a wind or solar farm, you are faced with the potential of unused surplus energy as certain times of the day. Without a cheap way to store or transport it great distances, the profitability drops significantly. Enter Bitcoin, the surplus energy generated from the wind or solar can be used to mine Bitcoin in the off hours. This could bring the profitability of the investment up to a point that it would be economical for more renewable sources to be built.

The implications of this could be staggering. Bitcoin mining would act as the electricity buyer of last resort, potentially spurring the development of renewable energy sources that were previously not economical to develop.

Counter Argument 3: Other Positive Externalities

Mining farms are changing the way with which data centers are traditionally run. Never before has the efficiency of a data center been so closely tied to the bottom line of a business. Traditional data centers now use 2.22% of worldwide electricity (Bitcoin mining uses 0.3%). Power usage effectiveness (PUE) is a measure of how efficiently a data center uses energy, and studies have shown that traditional data centers operate with 44% less efficiency than a mining farm.

If the cost savings and efficiency techniques used by mining farms can be adopted by traditional data centers, the energy savings could be dramatic.

Conclusion

To summarize, putting the Bitcoin energy argument into context is extremely important. While saying Bitcoin will exponentially increase its CO2 emissions ad infinitum may generate clicks — it is simply not true. Additionally, the potential externalities of the rise of Bitcoin make its net effect on the environment extremely difficult to forecast. The fact that there is a scenario in which Bitcoin is mined with and/or spurs a clean energy revolution is evidence of the endless range of possibilities.

In the end all we can do is observe and update our views based on new information. Or perhaps even before that we need to have our current views reflect current information, and not on a selective biased version of the latter.